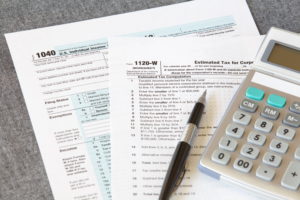

Tax Day is around the corner, and small businesses everywhere are ensuring their math is correct and all the right boxes are checked. If your tax prep has been more complicated than you think it should be, a good payroll system can help simplify things.

Tax Preparation

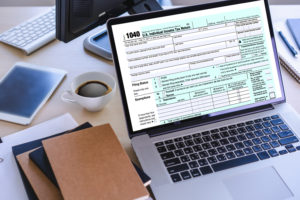

Our accountants are here to help you with your MA tax preparation. Here are some deductions you shouldn’t overlook.

Whether you’re filing your taxes yourself or hiring an accountant to help you with tax preparation in MA, it’s important to get all your ducks in a row before the year ends.

As a tax preparation company, ABC Payroll understands how much time and effort goes into filing a complicated return. But we also want to help make filing your taxes next year a little bit easier.

Every year, millions of Americans—about one-third, actually—wait until the last minute to file their taxes. So if you’re a procrastinator, you’re certainly not alone. However, trying to get everything filed on time can be pretty stressful. We understand; it’s a lot to remember!

Tax preparation services help you find all the deductions applicable to you. Here are some of the deductions you may be able to claim if you work remotely.

The end of the year is just a few weeks away, and for business owners, that means double checking your employees’ W-2s are all present and correct.

Tax preparation in MA isn’t something you want to think about in the summer, but if you take the time now, tax season will be a breeze.

Tax day is right around the corner! Are you ready? 2022 Tax Day is April 18, and you want to ensure that you have everything squared away and filed by the deadline. If you haven’t filed your taxes yet, here are a few tips to help your last-minute tax prep go smoothly and to maximize your tax refund.

Filing your taxes in one state can be complicated enough, but what if you need to file in two? There are plenty of reasons why you might need to file in multiple states. Maybe you moved in 2021 or you work in a different state than you live. Whatever the reason, you want to […]